The Impact of Implementing Cesare’s Law On the Syrian Economic and Livelihood Scene

Khalid Al Terkawi

Introduction

In late 2019, the last US sanctions law, referred to as Caesar Act, was signed and it entered into force in mid-June 2020.

The implementation of the law has come at a very difficult stage as the Syrian economy has been suffering from a decline in various indicators. In addition, the Syrian economy has experienced a decrease in standards of living and decline in the humanitarian situation in the various regions due to the protracted conflict that has destroyed much of the production system and infrastructure as well as displacing millions of Syrians and emptying entire cites.

The implementation of the law will continue as long as Syrian areas continue to be bombed or besieged, the flow of humanitarian aid to civilians is prevented, forced displacement continues, mechanism to hold accountable those responsible for the crimes committed are not developed and civilians are arbitrarily detained.

The law stipulates that the Central Bank of Syria’s transactions must be evaluated within 180 days of its entry into force, which is due at the end of 2020. It is expected that the U.S. Treasury Department has already submitted its report to the relevant congressional committees about the Central Bank’s operations, and whether it is carrying out Money laundering operations for the benefit of the Syrian regime. The report is expected to identify foreign persons and government agencies who are mainly within the scope of the stipulated sanctions.

The law also stipulated that it is necessary to create lists of foreign figures and parties that help the Syrian regime to perpetrate the violations against civilians mentioned above.

From the outset, the Caesar Act has aimed at isolating the Syrian regime from by imposing sanctions on any entity/personality that deals with the regime in matters considered under the subject of the sanctions. The law also aims at halting reconstruction operations and the flow of any potential funds for investment in Syria and reducing the main resources of funding available to the Syrian regime.

The law also seeks to prevent the regime from benefiting from advanced technologies in the field of communications, energy, and other fields. It encourages organizations and individuals to submit reports and documentation on human rights violations in Syria and pushes for humanitarian institutions wishing to operate in areas controlled by the Syrian regime to carry out their activities away from the Syrian regime.

However, all the stipulations and points mentioned are subject to debate from the various parties concerning what has been implemented, what can be implemented, and what are the effects of implementation.

This report is published five months after the Caesar Act entered into force, as it is necessary to review the effects of its implementation, on the Syrian regime and civilians living in regime-controlled areas or in areas beyond its control. This research aims to conduct a review of what has been implemented so far and the resulting impact of in the effects of the implementation process.

First: The Syrian Economic Scene before the Implementation of the Caesar Act

At the beginning of 2020, the population in Syria had reached nearly 16 million . Figures from international institutions such as the World Bank indicate that the number may reach 17 million . The population is divided into three principle regions:

1. Areas controlled by the regime

2. Areas controlled by the opposition in northwestern Syria

3. Areas controlled by the Syrian Democratic Forces (SDF) east of the Euphrates River

The Gross Domestic Product (GDP), which amounted to 55 billion US Dollars (USD) in 2010 , severely declined due to the negative impact on primary production activities as most factories went out of service, oil production declined by more than 90%, tourism fell to near zero rates and exports declined from 9 billion USD in 2010 to less than 700 million USD in 2018 (and it is expected to continue roughly the same in 2019). In addition, the Central Bank’s cash reserves decreased from 21 billion USD before 2011 to less than one billion in 2019 .

Although the annual per capita share of the GDP was close to 3000 USD before 2011, the significant decline in the GDP and the currency value makes the per capita share less than 900 USD for 2019, and not more than 500 USD annually for 2020 estimates.

Poverty rates in Syria were high compared to other countries of the world even before 2011, as the World Bank estimates indicate that at least a third of the population lived on a daily income below the poverty line. With the developments, poverty rates increased dramatically, and the number of people living on less than 1.9 USD a day was estimated at more than 80% of the Syrian population by the end of 2019.

Prices have increased dramatically as a result of the devaluation of the Syrian Pound (SP) and the decrease in the real income of Syrians resulting in a decrease in purchasing power. For example, the price of bread (the main basic food commodity) has doubled in regime areas more than ten times and in opposition areas by more than twenty times; this phenomenon can be generalized to most basic goods. which rose on average about ten times at least between 2011 and 2019, which is what It applies to communications and transportation, and home and clothing rents.

Unemployment rates were estimated at around 8% in Syria in early 2011 and have risen dramatically to more than 60%. In regime-controlled areas, most of the working-age population is engaged in governmental or quasi-governmental jobs whereas in areas outside regime control or under SDF control, they are engaged in jobs related to managing or protecting the areas. A very small number of residents maintained their jobs in the agricultural sector or returned to it after an interruption as has been the case for both Daraa and Homs’ northern countryside since the beginning of 2018; therefor, unemployment rates are the highest in the industrial and construction sector as a large percentage of factories and workshops stopped working and construction work decreased to be limited to small maintenance work that pays little money.

For financing its major purchases, the regime government relied on businessmen surrounding, who were given unlimited privileges before and after 2011, and these actors formed the basis for its main financing process. The government also managed to obtain resources from passport fees and visitation fees paid by expatriates. In addition to taxes and service charges for services it insists on providing.

At the beginning of 2020, many disagreements emerged among the business class, whose resources began to decrease due to the regime consumption. In addition, they faced a weakness in the resources available to them inside Syria, even with the advantage of the monopoly they enjoyed in cooperation with the regime, so the Makhlouf - al-Assad struggle emerged clearly in the first half of 2020.

Since mid-2014, there has been talk about the need to impose deterrent sanctions on the al-Assad regime against the background of the testimony provided by a dissident photographer nicknamed ‘Caesar’. The law was finally approved at the end of 2019 after a lengthy deliberation process. Since the signing of the Act, the regime’s hope regarding the flow of reconstruction funds necessary to reorganize the status of its institutions and restore what the war damaged disappeared. With the Act entering into force in the mid-2020s, it appears the Syrian economy and livelihood situation is heading towards a new and unprecedented stage.

Second: The Practical Implementation of Caesar’s Act

Nearly ten months have passed since the Caesar Act was signed (late December 2019) and nearly five months since it came into effect (mid-June 2020), during which sanctions have been imposed on Syrian and foreign persons and entities, and the Syrian regime was noticeably isolated. The most prominent points from Caesar’s Act that have been implemented until now are:

1) Punitive measures against Syrian institutions and individuals

Since the entry of the law into force, the USA, through its Treasury and State Department, issued lists including the names of 75 Syrians, headed by Bashar al-Assad, his wife and his eldest son as well as close associates including businessmen and officers. Companies and entities connected to the regime were also primarily targeted such as the 4th Corp and the different companies associated with the targeted businessmen.

2) Tighter sanctions against supporters of the Syrian regime especially in Lebanon and Iraq

The tightening of sanctions was imposed due to their association with Iran and the Syrian regime. Among the most targets were Nabil Qaouk and Hassan Al-Baghdadi, both leaders in Hezbollah, who were blacklisted at the end of October 2020; two former Lebanese ministers, the former Minister of Public Works and Transport and the former Minister of Finance were included on the list a few days prior. In Iraq, the al-Balad Bank was targeted at the end of October 2020.

In November 2020, sanctions were also imposed on the Lebanese President’s son-in-law and the former Minister of Foreign Affairs, Gebran Bassil, over his association with Hezbollah and the Syrian regime .

3) Implementing Program to Close Illegal Border Crossings with Syria

The USA has pressured the Lebanese and Iraqi governments to prioritize the monitoring and closing of illegal border crossing points. This operation aims to achieve multiple objectives including isolating Iran from the area, monitoring Hezbollah and the Syrian regime’s movements and ensure the effectiveness of the sanctions on all their entities.

In this context, a large media campaign was carried out in Iraq and Lebanon highlighting the importance of closing these crossings. The campaign aimed at gaining support for measures to limit the smuggling of strategic goods such as fuel and the like .

4) Restriction on Ships Carrying Fuel to Syria

The leaked Vincennes documents revealed that fuel reaches the Syrian regime through a complex logistical process that includes switching ships, concealing the destination and introducing multiple intermediaries before transporting the fuel to its final destination .

5) Providing Humanitarian Aid

In September 2020, the US government announced an additional support program of 720 million USD for Syria . However, the impact of this aid is minimal compared to the scale of Syrians’ suffering in areas under regime control and the areas outside its control.

It seems that the US realizes it is easy for the regime to evade sanctions while located among its allies. Thus, in the previous phase the US sought to “isolate the Syrian regime" by denouncing smuggling and illegal border crossings with Syria, through its partners in Lebanon, Iraq and in Jordan; although Jordan’s borders with Syria are the most organized. The US aims to impose punitive measures against Iran and the regime’s partners in Lebanon and Iraq, and motivate regional governments to turn away from the axis through which the Syrian regime operates.

It appears that the Syrian regime realized the seriousness of this step from the first day it was implemented. On June 28, 2020, Wael al-Mekdad, the Syrian Deputy Foreign Minister, confirmed that “neighboring countries are targeted by the Caesar Act as much as target Syria, and it is in their interest to continue coordination with Syria,” . At the end of 2019, the Syrian ambassador to Lebanon stated that Syria is ready to supply Lebanon with electricity, and to solve the energy crisis in exchange for coordination and cooperation with Syria . This point was reaffirmed by the then Foreign Minister Walid al-Muallem in August 2020 following the Beirut port explosion . Salim Jreissati, advisor to the Lebanese President, said that “coordination with Syria is still in place to overcome the effects of Caesar,” adding that they had raised the issue of Lebanese trucks passing through Syria with the Jordanian counterparts.

Third: the effects that resulted from the application of the Caesar Act

With the start of November 2020, the economic situation in Syria appears to be catastrophic, as across Syria living conditions have worsened to an unprecedented degree. It is possible to outline the main parameters of the economic scene according to the following points:

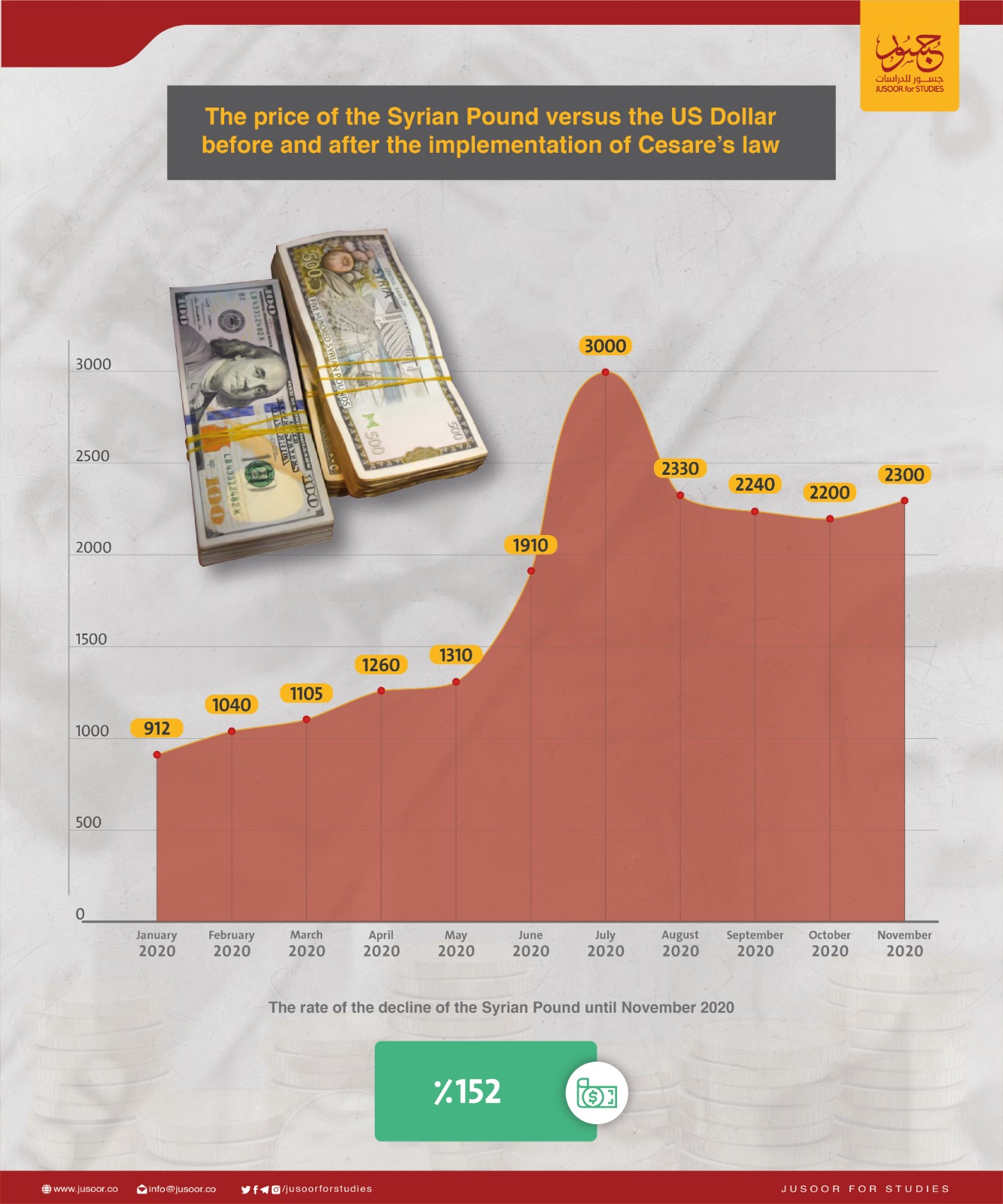

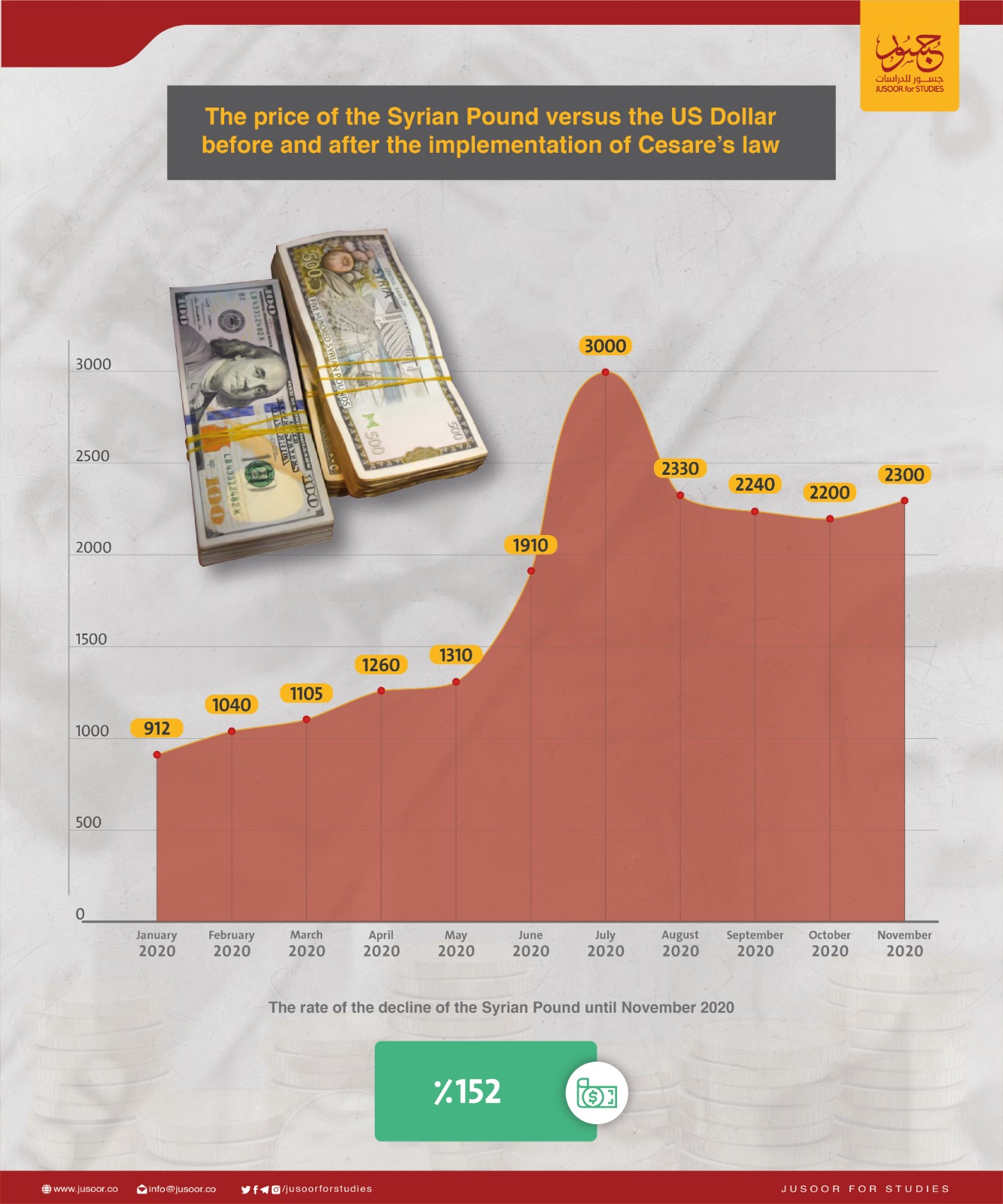

1) The Syrian Pound

The price of the Syrian Pound on the black market reached nearly 2,500 SP per USD, forcing the Central Bank to raise the price of delivering transfer to 1256 SP per USD . This measure was insufficient to address the problem, as the lira has undergone great fluctuations and faces a possible decrease in price at any moment, so we find that confidence in the pound has reached its lowest levels ever.

The Syrian regime has taken important steps which helped to partial control prices and reduce speculation on the pound. At the beginning of 2020 (before the Caesar Act came into force), it tightened the punishment for individuals dealing in currency other than the Syrian Pound, including dealing in gold, by decreeing a penalty of hard labor for four years with a fine . In addition, the penalty for those who broadcasts news about an exchange rate other than the official rate was also increased .

However, the most important laws to control currency were aimed at prohibiting the sale of vehicles and real estate except in Syrian Pounds, and dependent on opening a bank account to complete the transaction .

The price of the Pound against the USD witnessed a significant decline prior to the Caesar Act entering into force in early June. It reached more than 3,500 Pounds per USD, prompting the security services to increase their control over the markets, ensure the implementation of the above decrees, and stress that the Money transfer offices pay the amounts in the Syrian Pound exclusively for the Pound to return and settle below 2000 Pounds per USD.

It appears that in the period prior to implementation, the Pound was affected by fears of it collapsing upon the implementation of the Caesar Act. This fear prompted many people to abandon it inside and outside regime areas, including in northern Syria where the population began calling for the currency to be substituted for more stable currencies.

2) Prices

The decline in the exchange rate and the loss of many basic commodities contributed to increasing the price of these commodities; a noticeable hike in the prices of basic commodities was observed. In the first quarter of 2020, a kilogram of tomatoes or potatoes cost around 400 Pounds for the price to increase to 550 Pounds in early June 2020; chicken cost around 1,200 Pounds in the first quarter to rise to around 2000 Pounds in June.

With the start of the winter season in Syria, the government raised the price of diesel for industrialists to 625 Pounds per liter, while maintaining the prices of diesel used for heating at 296 Pounds per liter; this is the second time the price has been raised as it was previously raised in 2017. The price of a liter of (high-octane) gasoline was raised from 850 Pounds to 1050 Pounds, and the price of normal gasoline was raised from 450 Pounds to 850 Pounds.

These increases will inevitably lead to a rise in the prices of other basic goods and services. It is necessary to note that the price of a bundle of bread rose from 50 Pounds per bundle to 100 Pounds . In addition, the price of 100 pounds per bundle is the subsidized price and it is lower than the price of a bundle in northern Syria, which reached 400 Pounds; however, there is a difference in the type of flour used in both regions, as northern bakeries rely on high quality white flour while the regime-controlled bakeries depend on a mixture of white flour and bran, making it relatively more affordable, but in both areas the price is lower than the production cost.

3) Foreign Trade

The land borders were the first thing the regime lost control over which reduced land trade more than any other period. The foreign trade relied on smuggling operations mostly except for the border with Turkey as Turkey kept commercial border crossings open allowing the exportation of some of basic commodities and continued importation operations. Lebanon also maintained more land trade relations than any other country with regime areas, but smuggling operations became more developed and systematic. The border with Lebanon became mere lines on the map after Hezbollah began participating in the battles in Syria.

Official Syrian exports decreased from 8.7 billion USD in 2010 to less than 2.3 billion USD in 2012. This remarkable decline resulted primarily from the cessation of production in most Syrian regions. The exports subsequently decreased to less than 720 million USD in 2018 . This decrease was caused by multiple factors related to the disruption of supply chains, including the disruption of the main road network and the regime losing control over most of the land border crossings.

Also, much capital stopped working inside Syria, and much of the human capacities migrated from the country. It is expected that exports did not exceed 700 million USD in 2019 . Most of these exports are composed of agricultural materials including vegetables, fruits, cumin, olive oil and cotton as well as some manufactured items, especially clothing.

Imports also decreased from 17 billion USD in 2012 to less than 7 billion USD in 2018 . It is not expected that these figures have witnessed a fundamental change since the Caesar Act was enforced since the main countries imported from are mostly China, Russia and Iran. As for exported goods, they are mainly food commodities whose values do not exceed a few million Dollars annually, and they are exported to the Gulf states and some neighboring countries.

4) The Central Bank of Syria

Previous years witnessed the Syrian regime facing numerous sanctions packages prior to the Caesar Act, most notably those of the Arab League and the European Union (EU) as well as sanctions imposed by Canada, Australia and the US. These sanctions included a travel ban and an asset freeze for major figures participating in the crackdowns against demonstrators. However, the item that is expected to have affected foreign trade the most, was the prohibition on dealing with the Syrian Central Bank and the Syrian Commercial Bank which are owned by the government.

These sanctions negatively affected public and private institutions’ abilities to import from foreign countries, as EU countries represented 25% of Syria's imports in 2010 to decrease to 10% in 2018 . It is expected that this share will diminish, especially after Caesar Act came into force as European institutions have become even more conservative towards Syrian institutions regardless of their location.

5) Cash Reserve

The Syrian cash reserve has suffered a major collapse because of the government’s attempt to defend the declining price of the Syrian Pound, and the regime relying on this reserve to finance high-cost military operations without a renewable source for these reserves during a war that has lasted nearly ten years.

Official statistics indicate that in 2010, the Syrian cash reserve was close to 21 billion USD . This reserve has been eroded whereby Prime Minister Imad Khamis declared at the People's Assembly session, at the end of 2019, that Syria possessed zero reserves .

Perhaps the context for the Prime Minister’s speech is that the numbers have decreased dramatically to near zero, as the Central Bank is expected to have between half a billion to a billion USD in its treasury by the end of 2019 collected from passport fees, cash payments for entering the country, fees paid for military exemptions as well as fees collected by consulates to register marriages, births, deaths, and other transactions. This figure also includes possible incoming revenue from remittances which have increased dramatically in recent years. It is not expected that the Caesar Act will materially affected these figures which were initially low.

However, the series of sanctions included preventing access to international loans, dealing with borrowing institutions, or even cash donations, which weakened government institutions’ ability to achieve a diversification in the sources.

6) The Banking System

Syrian banks practice the bare minimal of business necessary for their survival. Prior to 2011, private banks had just started entering the Syrian banking market where six government banks had dominated the market for a long time. The largest of these 6 banks was and still is the Syrian Commercial Bank, which accounted for 40% of the business in the banking sector, and its deposits were estimated to amount to nearly 273 billion Pounds in 2010; in 2018, this estimate rose to 874 billion Pounds, a little more than three times. However, the exchange rate had increased by more than eight times and the monetary mass in the markets had increased accordingly.

In 2010, foreign currency was estimated at 550 million USD to drop below 322 million as demand deposits. Long term deposits decreased from 160 million USD to less than 73 million USD .

Most of the private banks work to increase their capital from profits by offering bonus shares instead of distributing profits, to keep up with the inflation in the price of the Pound. For example, Al Baraka Bank and Syria International Islamic Bank raised their capital to 15 billion in 2019, by distributing free shares instead of profits. Al Baraka Bank was established in 2007 with a capital of 3.25 billion Syrian Pounds, and its customers’ deposits in 2010 were around 586 million Syrian Pounds (12 million USD at 2010 exchange rate). By the end of 2019, these deposits had grown to reach 96 billion Pounds 80 million USD at 2019 exchange rate), which is a significant increase in the Syrian Pound indicating the popularity of conducting internal bank transactions using the Pound . The Syria International Islamic Bank’s current accounts grew from 12 billion Syrian Pounds in 2010 (240 million USD) to around 140 billion Pounds in 2019 (100 million USD at 2019 exchange rates) .

Although these banks were able to keep their business to a minimum inside the country, they face real problems in establishing international cooperation, as most private banks have one or more board members who are affected by European or American sanctions. This situation means banks are unable to work in borrowing and lending, bringing in foreign currencies, or financing large-value import operations. As such, Syrian businessmen have relied more on Lebanese banks, which - until the start of the Lebanese financial crisis in late 2019 - carried out most commercial transactions.

It is believed that foreign transactions through Lebanon decreased to a minimum following the Beirut port explosion and the enforcement of the Caesar Act, and the banks operating in Syria have not yet been able to cover the gap in need.

7) The State Budget

The budget clearly declined not only in terms of its value but also its effectiveness. The budget is one of the most important financial tools to control liquidity, activate markets and stimulate investments and development processes. However, the Syrian budget, denominated in foreign currency, began to decrease suffering from deficits amounting to 35% of the 2020 total budget resources . In the 2021 budget, the deficit is around 30% of total resources , and it appears that government agencies have reduced their expenditures to the lowest levels possible. The government has also started relying on every tool possible to finance the deficit, including confiscating the funds of their supports such as the case of Rami Makhlouf, and issuing bonds and deposit certificates which puts pressure on the assets of already weakened banks.

8) Poverty

Based on the international poverty line of 1.9 USD per day, nearly 80% of the population falls below this line and these percentages are relevant from before the enforcement of the Caesar Act. In any case a huge percentage of the population is expected to experience worsening conditions with the decrease in the exchange rate and the rise in the prices of all goods and services.

9) Reconstruction

With the beginning of 2020, it seemed that starting reconstruction processes might be closer than any other time, and the government’s efforts in this regard increased as the war across regions had ended clearing the way for reconstruction processes to begin.

It seems that the Caesar Act has disrupted the Syrian government and Russia’s efforts in this regard. It even nullified any preparations for the reconstruction efforts, as the Act clearly stated that participation in the reconstruction efforts falls within the framework of sanctions.

10) Technologies

The “Syrian e-government” project and the “smart card project” are considered the government’s two most important technological projects.

The e-government project dates to Bashar al-Assad’s arrival to power and is based on introducing automation projects in various government institutions. Electronic archiving projects have been carried out for civil, real estate and customs records, but these efforts are weak in terms of communication, access to these databases and due to the absence of electricity. The Syrian government institutions depend on local companies and programmers to execute these projects. For example, the customs office, the Real Estate Interests Foundation, the Syrian Investment Authority and the Ministry of Interior depend on the Syrian Company for Information Technology, that was founded in 2011, to execute projects. The Syrian Company for Information Technology’s director, Dr. Bayan Bitar was subject to European sanctions in 2017. The company continues to win the largest contracts automating institutions, and it relies on US database management applications such as Oracle and others.

As for the “smart card” project, it is entrusted to the Takamul company, which is considered close to Asma al-Assad, since her cousin, Muhannad Dabbagh, is one of the main owners of the company. Takamul has already started developing smart cards dedicated to the distribution of fuel, bread and basic materials. It also sells readers with cards and integrated solutions for electronic cards.

The smart card project is considered the most recent for the government, which relies on it to limit the distribution of food commodities and control resources. However, the project suffers from slow communications and the almost continuous electricity cuts. In many bakeries in Damascus, they substituted the cards with wooden chips to facilitate their business due to the lack of electricity for long periods of time that made relying on the cards impossible . The company is expected that the company relies on Chinese technologies for most of its business.

11) Humanitarian institutions

In early July-June 2020, Russia and China objected to the initiative to bring in Belgium and German humanitarian aid through the Bab al-Salama and Bab al-Hawa crossings on the Turkish-Syrian border. Subsequently, objections were raised about two amendments to the project for the extension of aid to enter only via Bab al-Hawa . Russia wants to limit the arrival of humanitarian aid to the authorities in Damascus, and it seems that Damascus and Russia have become more adamant on insisting on this after the Caesar Act, as they now realize that the law aims to reduce the centralization of the delivery of humanitarian aid.

12) The al-Assad Regime’s Official Narrative and Syrian Society

In various occasions, the Syrian official narrative continues to attribute the rise in prices and poor living conditions to the sanctions and the Caesar Act. In early November 2020, the Minister of Finance stated in his discussion of the 2021 budget that the increase in the price of fuel was due to the sanctions , as pro-regime economists claim that the Caesar Act is the main reason for the deterioration of economic indicators . Similarly, the former Syrian Foreign Minister Walid al-Muallem connected “the strangulation of the Syrian people and the strangulation of the American George Floyd” .

This approach applies to the Russian position which adopts the regime’s narrative .

Fourth: The living and economic situation in the regime-controlled areas

The Pound witnessed a noticeable decline against the backdrop of fear of implementing the Caesar Act. It is noticed that there has been a more than usual increase in the value of the USD against the pound since the beginning of May 2020. The price increased from around 1500 Pounds per USD to more than 3500 Pounds per USD in the second week of June alone, to then stabilize at around 1,800 Pounds at the end of the same month.

Based on the other factors that may result in the decline of the Pound in June, the logical price should not be greater than 2000 Pounds per USD. As such, the decrease in the price within a month is expected to be the result of fear of the Caesar Act entering into force (see Figure No. 1).

Figure NO (1)

Various interconnected circumstances overlap to result in the rise in the prices of goods and services including: the devaluation of the currency, the absence of a productive apparatus capable of keeping up with demand, smuggling and limiting goods to individuals or institutions, strategic areas not being controlled by the regime, transportation operations and the like.

However, it appears that commodity prices increased in the last quarter of 2020 compared to the second quarter of the same year (see Figure 2). Although most of the main commodities or their raw materials were produced locally before 2011, such as bread, vegetables, fruits, meat and various types of food, fuel, most types of clothing, most of medicines and the like, the regime losing it control over the fuel and wheat, disruptions to the agricultural sector and the smuggling of much of Syria’s livestock outside of the country fundamentally impacted the country. The government and private sector institutions’ ability to finance their purchases has weakened and become more expensive following the enforcement of the Act.

Figure NO (2)

.jpeg)

It is expected that the implementation of the Caesar Act will have limited impact on foreign trade as exports and imports are at their minimum level. The implementation of the law and restrictions on trade with Syrian institutions may result in the 700 million USD in exports declining a few million dollars. In most of cases, the commodities exported are not covered by the law, and, for the most part, they are carried out by small-scale local producers who are unknown on the economic scene.

It is expected that the US Treasury Department will review one of the Caesar Act’s articles relating to the Central Bank of Syria, as the law stipulates that the activities of the Central Bank of Syria will be reviewed within 180 days of imposing the law, that is, by the end of 2020. As such, the worst is yet to come for the Central Bank of Syria as due to European, Arab and American sanctions, the Central Bank of Syria will be a source of threat to any institution in the world that deals with it. The Central Bank also become unable to formally deal with even institutions in China and other countries that have no qualms dealing with it to finance food or medicinal goods. Until the beginning of 2021 and the release of the outcome of the review, the Central Bank will continue to be able to deal with countries, that accept to deal with it, at a minimum. The review is expected to argue for classifying the Central Bank as aiding the Syrian regime’s money laundering and war financing operations. The Central Bank faces a situation where it will not have an opportunity for growth to replenish its already eroded cash reserve in the next few years at least and securing foreign funds will become one of the main difficulties it faces.

Although foreign partners maintain their stakes in private banks operating in Syria, as is the case in Al Baraka Syria, the Syria International Islamic Bank and others, it appears the sanctions imposed so far have not affected their branches outside Syria. It remains unclear whether the situation will continue like this. In the event of changes in this issue, it is expected that these institutions will exit from the market and they will sell their shares at some time in 2021 or later.

However, the Syrian banking system’s ability to support the activities of the Central Bank of Syria remains limited to handling minimum banking services. It is unlikely, especially due to the Caesar Act, for these services to expand any time soon.

On the budget level, the government’s ability to collect revenues and subsidize basic commodities has been affected. The 2021 budget prepared after the passage of the Caesar Act, accounted for the partial removal of subsidies on bread, industrial diesel and the price of gasoline, and it is expected that the investment projects approved in the budget will not be implemented except for those that are necessary to reduce the deficit.

There is no hope that salaries and wages will be increased proportionate to the rise in prices occurring in Syria, so the poverty rates will continue to increase in the coming period, and the government will not be able to influence it in any way, especially considering its inability to attract foreign capital and secure job opportunities. In the private sector, where salaries are relatively better than state salaries, the reconstruction operations have become a matter of the past due to the Caesar Act affecting possibilities for private sector growth or stimulus.

Fifth: The implications of the Caesar Act on the Livelihood and Humanitarian Situation in Northern Syria

In the late quarter of 2020, the livelihood situation in northern Syria has deteriorated further as the decline in the exchange rate of the Pound fundamentally impacted the price of goods and services. Although conducting transactions in Turkish Lira slightly improved the situation of prices, noticeably decreasing prices, soon the Lira was also facing a crisis represented by the decrease in its price against the USD which reflected on the prices in northern Syria. These fluctuations are clear in the case of Idlib and the countryside of Aleppo, as the price of a bundle of bread rose from 300 Pounds in early 2020 to more than 750 Pounds in May 2020 to then decrease slightly after it was pegged to the Lira price; the price then return to approximately 400 Pounds. The price of a kilogram of rice also increased, rising from 650 Pounds per kilogram in early 2020 to 1600 Pounds May 2020 before stabilizing in November at around 1,500 Pounds.

In the case of Deir ez-Zor and al-Raqqa (see Figure 3) which continued to conduct transactions in the Syrian Pound, prices remained stable until late June and then began to rise clearly. The price of a bundle of bread remained at 200 Pounds until July when it rose to 300 Pounds and settled at around 400 Pounds per bundle in November 2020. As for the price of rice, it rose from 750 Pounds per kilogram in early 2020 to 2,000 Pounds per kilogram in May. The price of rice witnessed this fluctuation as an imported good affected by the exchange rate. By November 2020, the price of a kilogram of rice had settled at 1,400 Pounds. It is necessary to note that the price of red and white meat remained cheaper than others until the end of 2020. The prices of commodities manufactured in Deir ez-Zor, al-Hasakah and al-Raqqa remained stable until the beginning of October 2020, when it appears that a large increase in demand resulted in a dramatic rise in prices. This increase in demand indicates that regime-controlled areas have begun to rely on these regions more than ever before.

Figure NO (3)

.jpeg)

Figure NO (4)

.jpeg)

Conclusions

• In general, we can refer to the stage that began with the Caesar Act into force in mid-June 2020 as the phase of isolating the Syrian regime through strict measures to close the borders. The measures seemed to bear fruit with respect to the Jordanian and Iraqi borders and is considered to have been implemented to a large degree along the Lebanese border although Lebanon is considered the Syrian regime’s backyard.

• The main figures/entities were also included or confirmed on the sanctions list without delving into the details of the businessmen or the government serving the al-Assad regime and providing it with principal support inside or outside Syria. The Central Bank of Syria has not been included in the sanctions so far, but its ability to navigate is less than it was at any prior time, and the Central Bank is expected to face more severe penalties by the end of 2020.

• The Syrian regime is still able to conduct deals to buy construction materials through Lebanon even after the Beirut port explosion, as these materials are imported through the port of Tripoli, and these materials are dealt with as legitimate products. The Syrian regime is also able to obtain basic commodities, especially grain and relatively good quantities of oil and gas, through the SDF controlled areas in eastern Syria, which are subject to US supervision. This American leniency may be due to many factors, including back channel negotiations between Washington and Damascus to release American detainees held by the regime, and enabling the Autonomous Administration to obtain necessary financial resources at a time when this access can be used to pressure the regime at any time.

• It seems that the economic indicators are in the worst possible condition, but the Caesar Act, as well as the other sanctions, do not bear all that happened. Rather, we can notice that the living and economic conditions of Syria were poorer than any other time in Syrian history prior to the implementation of the Caesar Act.

• It appears that the Caesar Act provided investors and businessmen outside and inside Syria with guarantees that the situation will not improve anytime soon. It also raised concerns among citizens affecting the price of the Syrian pound prior to the enforcement of the Act. It had a vital effect on preventing the flow of prospective investments from foreign countries.

• The US aid for the Syrian people did not have any effective impact in alleviating the deteriorating conditions in both regime and opposition controlled areas, and the needs gap is still very wide.

• It is also clear that the Syrian government is unable to fulfill its functional duties as was clearly demonstrated during the fuel crisis, the bread crisis and the fire crisis. The draft state budget for 2021 also highlighted the government’s financial weakness. On the other hand, it seems that the regime structures are still coherent, as the regime seeks to secure the necessary resources to sustain its principal institutions and works as much as possible to protect the societies loyal to it from crises.

References

------------------------------------

1- The researcher’s estimation of the population figure based on previous studies.

3- Based on the Central Office for Statistics figures.

4- UNESCWA estimates, Syria at War: Eight Years On, p.57.

5- Statements of the Prime Minister of the Syrian government Imad Khamis in the People’s Assembly at the end of 2019: https://bit.ly/3e0XAMe

8- Al-Khathimi Continues: Protecting Institutions and Borders in Iraq, al-Ghad. 21.09.2020. https://bit.ly/38cCRVV

10- FinCEN Files, Dubious Deals with Syria Result in the Killing of 20 Sailors, DW, https://bit.ly/2Iibmj7 ; Some sources, which have not been verified, mentioned that Russian ships accompany Iranian fuel carriers to Syria, and these restrictions represent a choking fuel crisis in Syria on the basis providing fuel is considered within the frame of sanctioned transactions stipulated by the Caesar Act. Russian endeavors to provide fuel to Syria may result in a confrontation between the US and Russia in the future. See: Browne, E. “World War 3: Russian Navy escorts Iranian Tanker to Syria as Risks of UK Intervention Mounts”, The Express. 22.10.2020.

12- Al-Mekdad to al-Watan: The Neighboring Countries are Targeted by the Caesar Act as much as Syria, al-Watan al-Suriyeh. June 2020. https://bit.ly/3eEG69L

14- Walid al-Muallem pays condolences to the Lebanese Minister of Foreign Affairs and Conveys Readiness to Assist the Country. https://bit.ly/2IlsqnP

15- The Lebanese President’s Advisor, Coordination Continues with Syria, al-Watan al-Suriyeh newspaper, 10.07.2020. https://bit.ly/2JPgmMC

16- The Central Bank of Syria Newsletter of Prices on the internet. CB.gov.sy

21- Increasing the price of a bundle of bread to 100 Pounds, Syrian Days, 29.10.2020

22- Syrian Statistical Group, and the Data of the Syrian Customs Authority

23- Researcher’s estimate based on previous studies

24- The Syrian Statistical group and the data of the Syrian Customs Authority

26- These figures were circulated by Syrian officials in 2010, and the economic professors in the University also repeated these figures in 2010. İt is possible to locate proximate figures in various sources including the al-Arabi al-Jadid article which depends on economic expert’s analysis: https://bit.ly/2Ih0SjT

27- The Prime Minister of the Syrian Government: The Central Cash Reserve, al-Sharq al-Awsat, December 2020. https://bit.ly/3e0XAMe

28- Annual Reports for the Syrian Commercial Bank

29- Annual Reports for Al Baraka Bank- Syria

30- Annual Reports for the Syria International Islamic Bank

31- Notes on the People’s Assembly Discussion on the Syrian Budget, Jusoor Center for Studies.

33- The Stupidity of the Smart Card, Syria Today. 25.09.2020. https://bit.ly/3p80jcN

34- United Nations, July 2020. https://news.un.org/ar/story/2020/07/1058111

35- Minister of Finance Declares the Reason fort he Economic Deficit, Palmyra News, November 2020

36- Obada Fadliyet, Decline in Imports due to Caesar, al-Watan Newspaper, October 2020. https://wp.me/pa98yp-Hdu

37- Syria accuses America of choking the Syrian People as it is did Floyd, Vision Switzerland. https://bit.ly/3k8unl3

38- Lavrov, Caesar Hurt Syrians, al-Watan, September 2020. https://wp.me/pa98yp-FJ

.jpeg)

.jpeg)

.jpeg)